This post may contain affiliate links which means I may receive a commission for purchases made through links. Learn more on my Private Policy page.

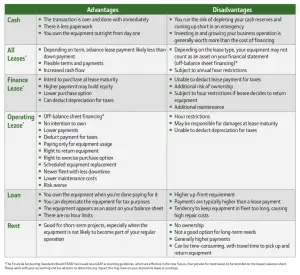

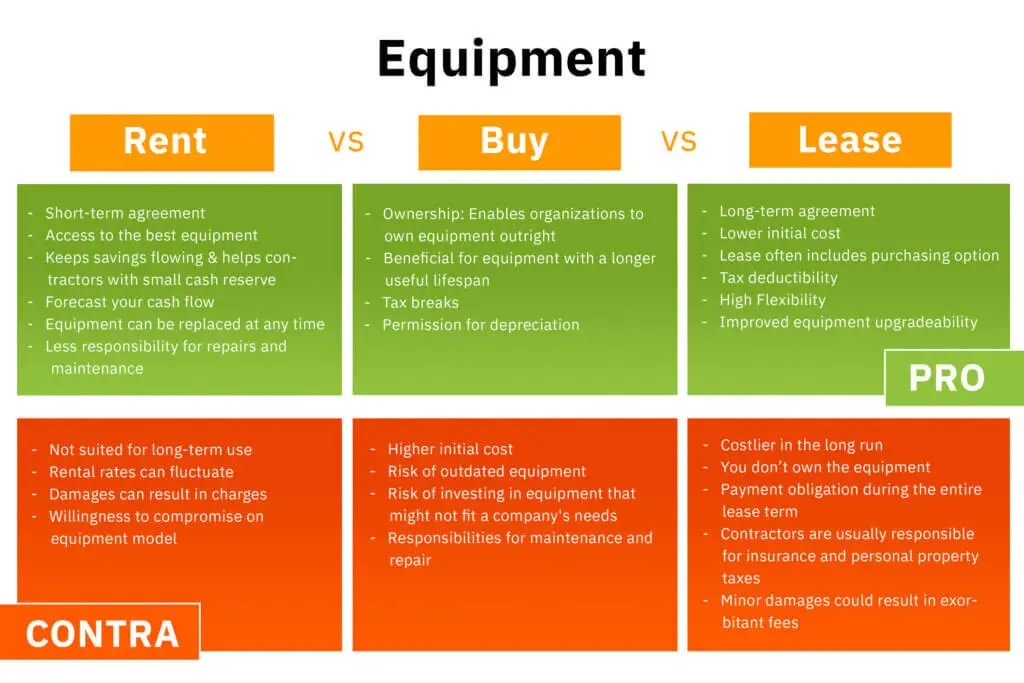

In the world of farming, it’s essential to have the right equipment to optimize productivity and maintain efficiency. However, when it comes to acquiring farm equipment, the decision between leasing and buying can be a tough one. Leasing offers numerous advantages like flexibility and affordability, while buying provides ownership and long-term cost savings. In this article, we’ll explore the benefits of leasing versus buying farm equipment, helping you make an informed decision that aligns with your farming needs and budget.

Lower Initial Costs

No large upfront payment

Leasing farm equipment offers the advantage of not having to make a large upfront payment. This means that you can acquire the necessary equipment without depleting your financial resources. By spreading the cost of the equipment over monthly lease payments, you can better manage your cash flow and allocate funds to other aspects of your farm business.

Flexible payment options

Leasing also provides you with flexible payment options. Instead of being confined to a single payment structure, you can choose terms that best suit your financial situation. Whether you prefer monthly or quarterly payments, or even seasonal payment plans, leasing provides you with the flexibility to tailor the payment schedule to your farm’s revenue cycles.

Access to Newer Technology

Ability to upgrade equipment easily

One of the biggest advantages of leasing farm equipment is the ability to easily upgrade to newer, more advanced technology. Agricultural machinery is constantly evolving, and leasing allows you to stay at the forefront of innovation without the burden of owning outdated equipment. By leasing, you can regularly refresh your equipment to take advantage of the latest features and advancements, ensuring that you have access to the most efficient and productive tools.

Access to the latest innovations

Leasing also gives you access to the latest innovations in farm equipment. Equipment manufacturers are constantly introducing new technologies and features that can enhance productivity, reduce fuel consumption, and improve crop yields. By leasing, you have the opportunity to use and evaluate these advancements firsthand, without the long-term commitment of ownership. This allows you to adapt to changing farming practices and remain competitive in the industry.

This image is property of www.agdaily.com.

Reduced Maintenance and Repair Costs

Warranty coverage

Leasing farm equipment often includes warranty coverage, which can significantly reduce maintenance and repair costs. Equipment manufacturers typically offer warranties that cover the cost of parts and labor during the lease term. This means that if any issues arise, you can rely on the manufacturer to address them promptly and at no additional cost to you. This can provide peace of mind and protect your farm from unexpected repair expenses.

Maintenance services included

Leasing often includes maintenance services as part of the package. This means that routine maintenance, such as oil changes, inspections, and repairs, can be taken care of by the leasing company or the equipment manufacturer. By outsourcing these tasks, you can save time and resources that would otherwise be spent on maintaining and servicing the equipment. This allows you to focus on your core farming operations and maximize productivity.

Flexibility and Adaptability

Opportunity to try different equipment

Leasing farm equipment provides you with the opportunity to try different models and brands without the commitment of ownership. This is especially beneficial if you are unsure about which equipment best suits your specific farming needs. By leasing, you can test different equipment options and determine which ones offer the greatest efficiency, productivity, and reliability for your farm. This flexibility allows you to make informed decisions when it comes to selecting and investing in equipment in the long run.

Easy equipment replacement

Leasing also offers easy equipment replacement. Over time, equipment may become outdated, require extensive repairs, or no longer meet your farm’s changing needs. By leasing, you can easily replace equipment with newer models that better align with your evolving requirements. This eliminates the hassle of selling or disposing of old equipment and allows you to seamlessly transition to more advanced machinery to enhance your farm’s operations.

This image is property of toolsense.io.

Tax Benefits

Lease expenses may be tax deductible

Leasing farm equipment can offer tax benefits. In many countries, lease expenses are tax deductible, reducing your overall tax liability. This allows you to effectively lower your equipment costs by taking advantage of tax deductions. However, it is important to consult with a tax professional or accountant to understand the specific tax implications and eligibility criteria in your jurisdiction.

Potential savings on operating expenses

Leasing also offers potential savings on operating expenses. Leased equipment is not subject to property taxes, unlike owned equipment. Additionally, leasing often includes maintenance services, as previously mentioned, which eliminates the need for costly maintenance contracts or hiring specialized personnel for equipment upkeep. These savings can contribute to the overall financial benefits of leasing farm equipment.

Improved Cash Flow

More predictable monthly payments

Leasing farm equipment offers more predictable monthly payments compared to the uncertainties associated with owning. With leases, you know exactly how much you need to allocate for equipment expenses each month. This allows you to plan your budget more accurately and avoid unexpected financial burdens. Predictable monthly payments can provide stability and help you better manage your farm’s cash flow, allowing for more efficient financial planning and decision-making.

Preserved credit lines

Leasing helps preserve credit lines for your farm. By not tying up large amounts of capital in equipment purchases, you can keep your credit lines open for other essential farm expenses, such as operating costs, expansions, or emergencies. This financial flexibility is particularly valuable in times of economic uncertainty or when unexpected opportunities arise, allowing you to react quickly and effectively without compromising your farm’s financial stability.

This image is property of southernagcredit.com.

Reduced Risk of Obsolescence

Avoidance of owning outdated equipment

When you own farm equipment, there is a risk of it becoming outdated as technology and farming practices evolve. By leasing, you can mitigate this risk and avoid the burden of owning equipment that has depreciated in value or become obsolete. Leasing allows you to regularly upgrade to the latest equipment models, ensuring that your farm remains competitive and efficient in a rapidly changing agricultural landscape.

Ability to adapt to changing market needs

Leasing farm equipment provides the adaptability needed to keep up with changing market needs. As the agricultural industry evolves, new challenges and opportunities arise that require different equipment specifications. By leasing, you can quickly and easily adjust your equipment inventory to meet these changing demands. This adaptability allows your farm to remain agile, responsive, and competitive, ensuring that you can effectively capitalize on emerging trends and technologies.

Convenience and Support

Assistance with equipment setup and training

Leasing farm equipment often comes with the added convenience of assistance with equipment setup and training. The leasing company or equipment manufacturer can provide on-site support to ensure that the equipment is properly installed, calibrated, and ready to use. Additionally, they may offer training programs to familiarize you and your farm staff with the equipment’s features, operation, and maintenance procedures. This comprehensive support ensures that you can make the most of your leased equipment from day one.

Technical support and troubleshooting

Leasing also provides access to technical support and troubleshooting services. In case of any equipment malfunctions or technical difficulties, you can rely on the expertise and assistance of the leasing company or manufacturer’s support team. They can provide timely solutions, remote diagnostics, or on-site repairs, minimizing downtime and maximizing your farm’s productivity. This level of support can provide peace of mind, knowing that you have expert help available whenever you need it.

This image is property of assets.forafinancial.com.

Ability to Match Equipment Usage

Lease for seasonal or temporary needs

Leasing farm equipment offers the flexibility to match equipment usage to your farm’s seasonal or temporary needs. For example, if you require specialized machinery during harvesting or planting seasons, leasing allows you to acquire the equipment for specific timeframes. This eliminates the need to invest in expensive equipment that is only needed for a limited period. Leasing enables you to optimize your equipment fleet for peak seasons, reducing costs and improving operational efficiency.

No need to store equipment off-season

Another advantage of leasing is that you don’t need to worry about storing equipment during off-season periods. Once the lease term ends, you can return the equipment to the leasing company, eliminating the need for additional storage space or maintenance. This can be particularly advantageous for farms with limited storage facilities or those that operate in regions with extreme weather conditions. Leasing relieves you of the responsibility of storing and maintaining equipment during non-essential periods, reducing operational complexities and costs.

Opportunity for Business Growth

Allocate funds for other investments

Leasing farm equipment allows you to allocate funds for other essential investments in your farm business. Instead of tying up capital in equipment purchases, you can use those resources to expand your operations, invest in infrastructure, or explore new revenue streams. By unlocking capital that would otherwise be tied to equipment ownership, leasing provides you with the financial freedom to strategically invest in your farm’s growth and long-term success.

Expand operations with leased equipment

Leasing also enables you to expand your operations with ease and efficiency. If you’re considering scaling up your farm business, leasing equipment can provide the necessary tools without the significant financial commitment of purchasing. Leasing offers the agility to quickly acquire additional equipment, ramp up production, or diversify crops without incurring a substantial upfront cost. This flexibility empowers you to seize growth opportunities, respond to market demands, and make strategic decisions that propel your farm business forward.

In conclusion, leasing farm equipment provides numerous benefits that can enhance your farm’s efficiency, productivity, and financial stability. From lower initial costs and access to newer technology, to reduced maintenance expenses and tax benefits, leasing offers a variety of advantages that can positively impact your bottom line. The flexibility, convenience, and support that come with leasing also position your farm for adaptability, growth, and success in the dynamic agricultural industry. By carefully considering your farm’s specific needs and objectives, leasing can be a valuable strategy to optimize your equipment fleet and elevate your farm’s operations to new heights.

This image is property of www.pequea.com.

This post may contain affiliate links which means I may receive a commission for purchases made through links. Learn more on my Private Policy page.